Intro to Credit Cards

Credit cards can be dangerous ways to get stuck in debt. But, if used knowledgeably, they can also be powerful tools for making future purchases easier and actually making some money back in the long run. Credit scores, a number assigned to every adult and largely determined by one’s credit card use, are just as important. A low credit score will prevent you from buying a car or home, renting an apartment, being approved for a loan, or even getting hired for a job. On the other hand, a high credit score will result in better deals on purchases and loans, lower insurance rates, and generally make life easier financially. While these things may not seem so important right now, there will almost certainly come a time where having a strong credit score will prevent you from a ton of headache or heartache. So while a credit score isn’t the end-all-be-all, having a good one can prevent a lot of future stress.

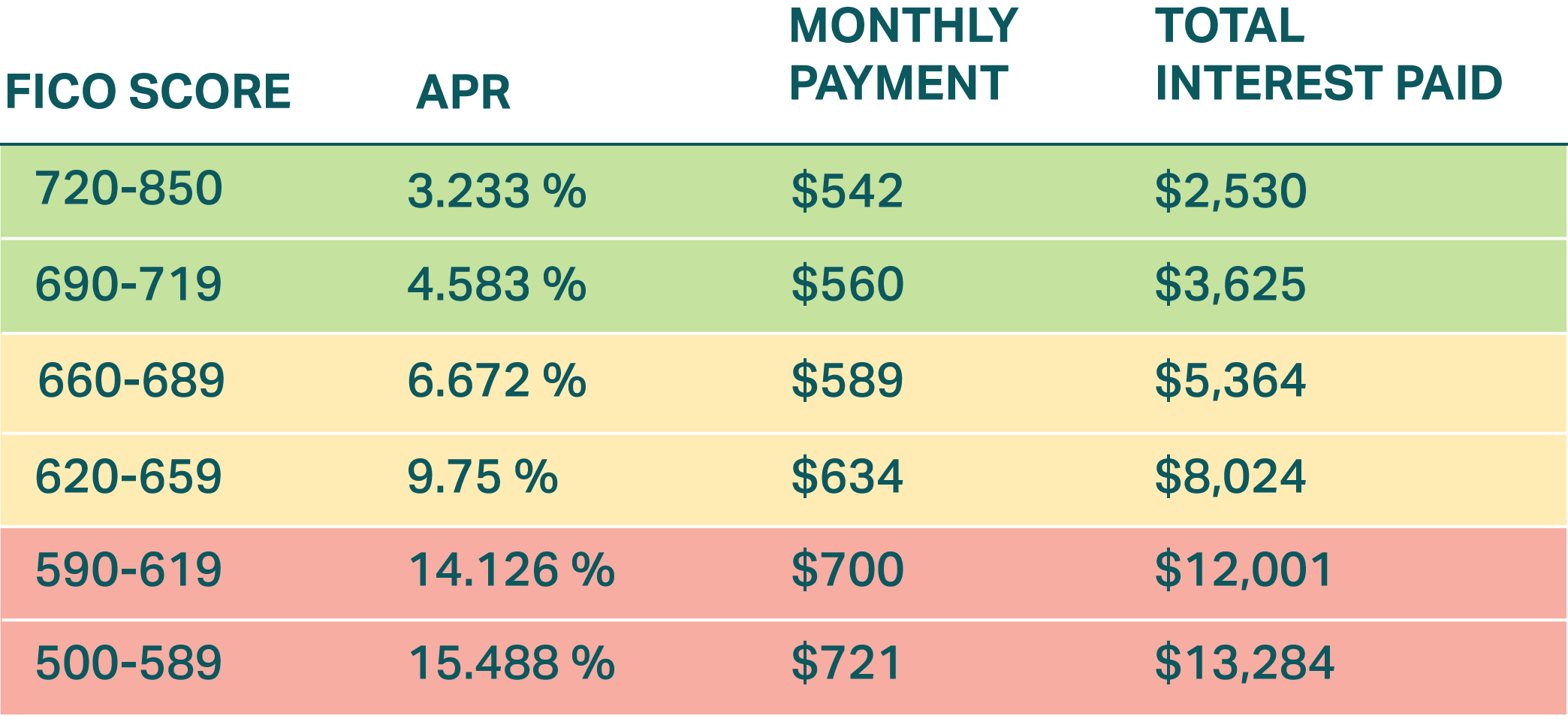

As a quick example, let’s say you want to buy a car, and you apply for a standard 5 year car loan. This chart shows the differences in how much that’ll cost you if you have a good/high FICO score (FICO is one of the main organizations that calculate credit scores) compared to a bad/low FICO score:

The difference between the monthly car payment for the highest credit score ($542) and the lowest ($721) = $179 month. That’s a total difference of $10,754 extra you would have to pay if you don’t manage your credit score! And saving money on loans is just one of the many ways in which a credit score plays a very important role.

So if you are thinking of getting a credit card, either now or sometime in the future, we highly recommend you continue following this map - we’ll walk you through what credit cards are, how to use them so they work best for you, and even suggest a couple of our favorite cards. If you aren’t thinking of getting a credit card, then we recommend you continue reading anyway - this map is packed full of important information, and once you read through, you may find your mind changed and realize you’re ready to get a card of your own.