Why should you Plan for Retirement?

The straightforward answer to this is because you would want to allocate enough money to spend after retirement. Additionally, retirement plans also provide tax advantages. No matter what retirement plans you choose, the government provides an incentive by offering TAX-FREE profits, as opposed to being taxed on your profits in your brokerage or investment account.

However, to dive deeper into the topic, this relates to the ideas of Compounded Interest vs. Simple Interest and Time Value of Money (TVM).

Compound Interest vs. Simple Interest

Albert Einstein once described compound interest as the “eighth wonder of the world, where he who understands it, earns it; he who doesn’t, pays for it”. Compound interest is the interest paid on an initial principal including all accumulated interest from previous periods. To break this down, if you invest $100 today with a 5% interest, you will receive $105 next year. The $105 then gets carried over to the year after, where we will end up with $105 * (1.05) = $110.25 in 2 years. This differs from simple interests, where you receive a fixed amount of interest every year based on your initial principal. Under simple interest, the same investment will yield $100 * (1.05) * 2 = $110 in 2 years.

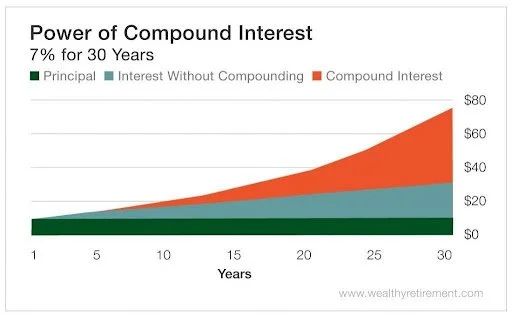

By stretching this idea out into a long period of time, there will be a huge difference in the ending amount. The graph below shows the comparison of a $10 investment with 7% annually over 30 years. It is clear that compound interest provides more value compared to interest without compounding (simple interest).

Source: Wealthy Retirement (www.wealthyretirement.com)

Applying this idea to retirement planning, the earlier you plan and begin investing in your retirement account, the more years before retirement you will have to capitalize on the power of compound interest. Since compound interest is represented by an exponential growth in value, your investments will correspondingly grow exponentially over time. While retirement is often undervalued by younger generations, it can be one of the most efficient ways to save up for a comfortable life post-retirement.

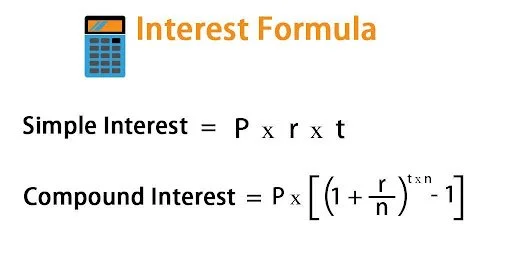

Here are the calculations of simple interest and compound interest (where P represents initial principle, r represents interest, t represents time, and n represents the number of compounding every year). You can see that compound interest is represented by exponential growth:

Source: EduCBA Finance (www.educba.com)

Time Value of Money (TVM)

Time value of money refers to the idea that the money you own now is worth more than the identical amount in the future. This is in part due to inflation, which gradually increases prices of products and services and decreases the quantity of products and services you can purchase with an identical amount of money. Time value of money is extremely important because it helps us make smart financial decisions. For example, the theory helps us in deciding whether receiving $500 today is better than receiving $750 5 years from now. More importantly, to combat the decrease in the value of money over time, you should actively invest in order to outrun inflation, which has consistently been around 2-3% per year over the last 30 years.

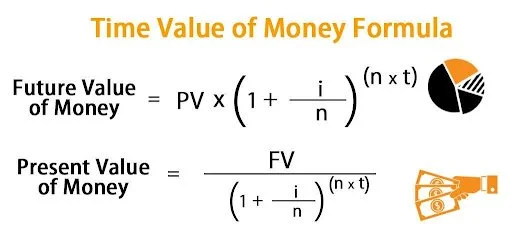

To calculate the future value of money or the present value of money, note the formula below (where PV stands for present value, FV stands for future value, i stands for interest rates, n stands for compounding period, and t stands for time – usually in years):

Source: EduCBA Finance (www.educba.com)